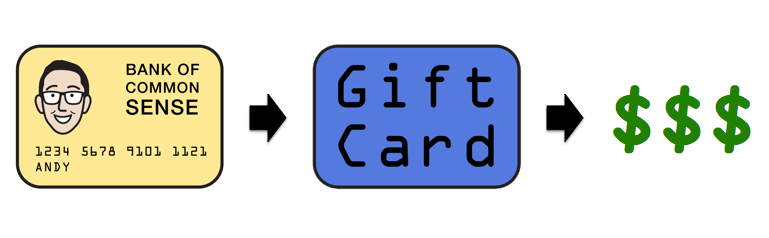

Remember how I get an effective reward rate of over 3% from my credit card? Well I take those gift cards and turn them into cash, giving me more cash than the 2% cards that top the cash back charts.

Remember how I get an effective reward rate of over 3% from my credit card? Well I take those gift cards and turn them into cash, giving me more cash than the 2% cards that top the cash back charts.

Here’s how I do it.

I use a great little service called Plastic Jungle. It’s a website that buys your unwanted gift cards and resells them to people who do want them. It’s arbitrage at it’s finest. It’s not like eBay where you are responsible for the transaction. Plastic Jungle gives you money and you’re done. No waiting, no annoying buyers, no hassle.

Your savings account probably sucks. If you hold an account at one of those banks everyone’s heard of (i.e. Bank of America, Chase, etc.) then you’re probably getting close to nothing in interest**.** I’m talking less than 0.1%. Expect to get a penny every once in a while.

Your savings account probably sucks. If you hold an account at one of those banks everyone’s heard of (i.e. Bank of America, Chase, etc.) then you’re probably getting close to nothing in interest**.** I’m talking less than 0.1%. Expect to get a penny every once in a while. You’ve decided you want to apply for a credit card, and you plan on paying the bill in full every month. Great! You are on your way to building a strong credit history.

You’ve decided you want to apply for a credit card, and you plan on paying the bill in full every month. Great! You are on your way to building a strong credit history. Happy Father’s Day everyone. I hope everyone is enjoying their day.

Happy Father’s Day everyone. I hope everyone is enjoying their day.